THE STATE OF

usage-based

pricing

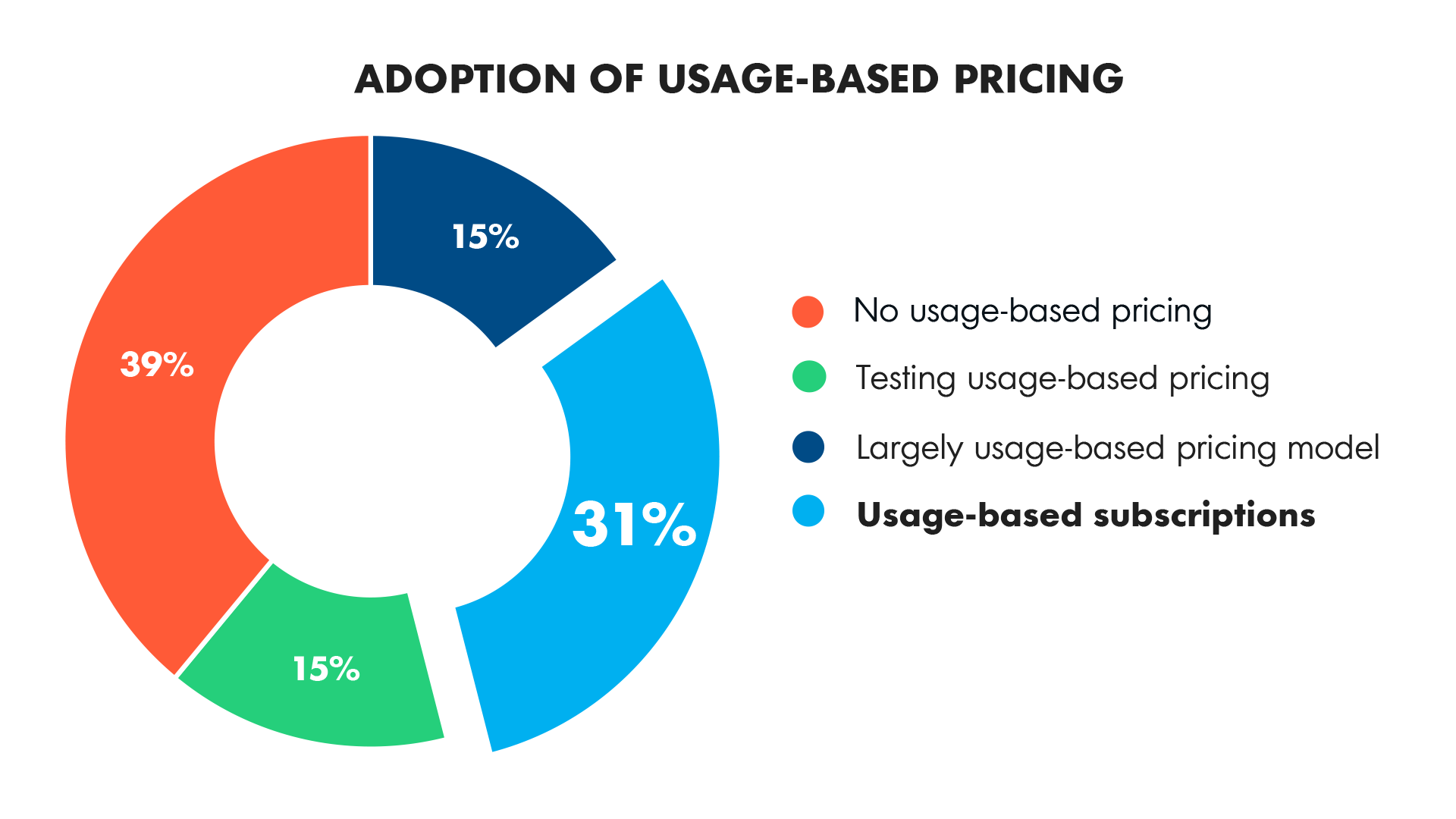

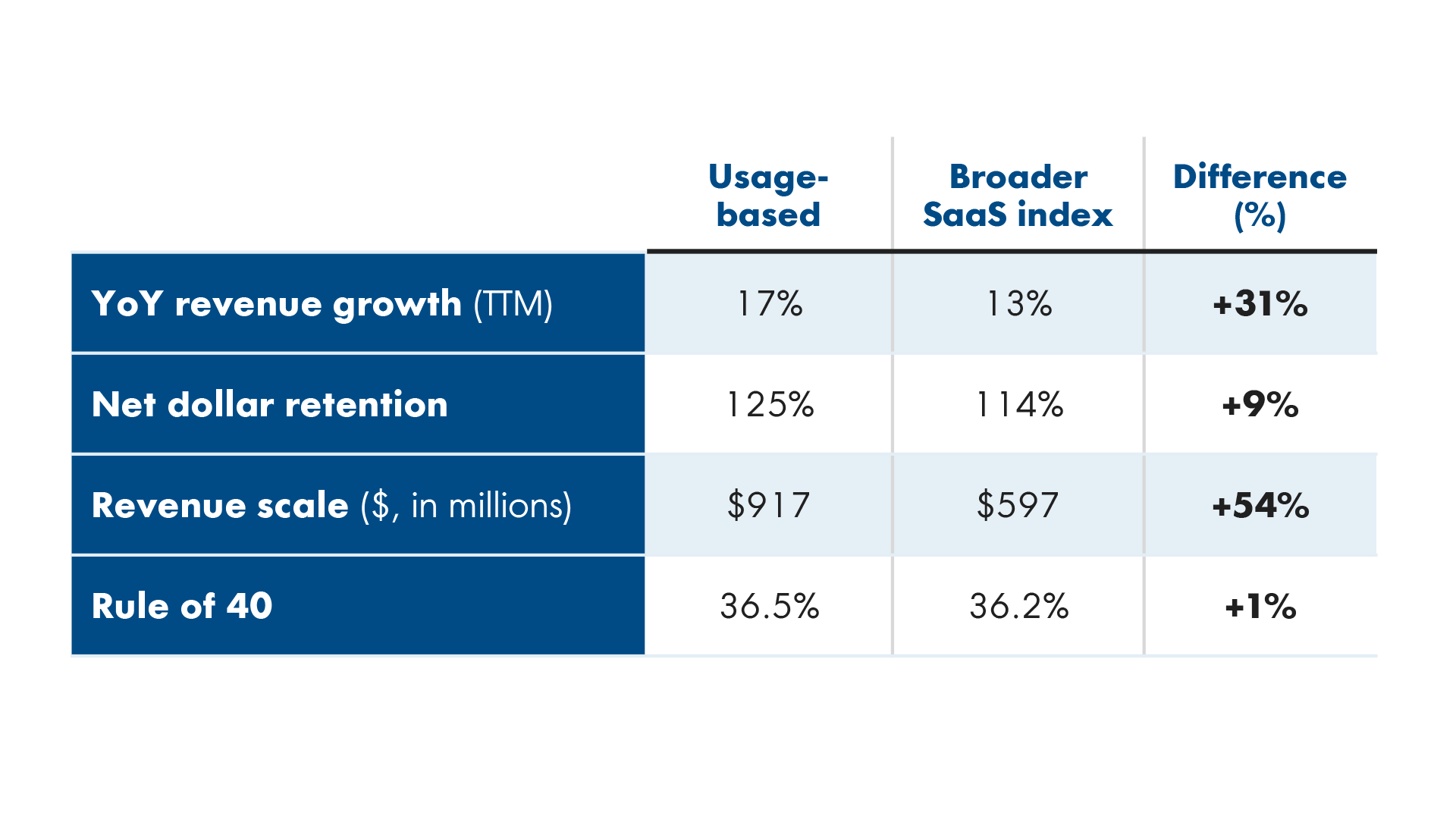

Usage-based pricing (UBP) has taken the SaaS world by storm. But with changing macroeconomic conditions, how will usage-based models continue to evolve and endure?

Authors: Kyle Poyar, Sanjiv Kalevar, Curt Townshend